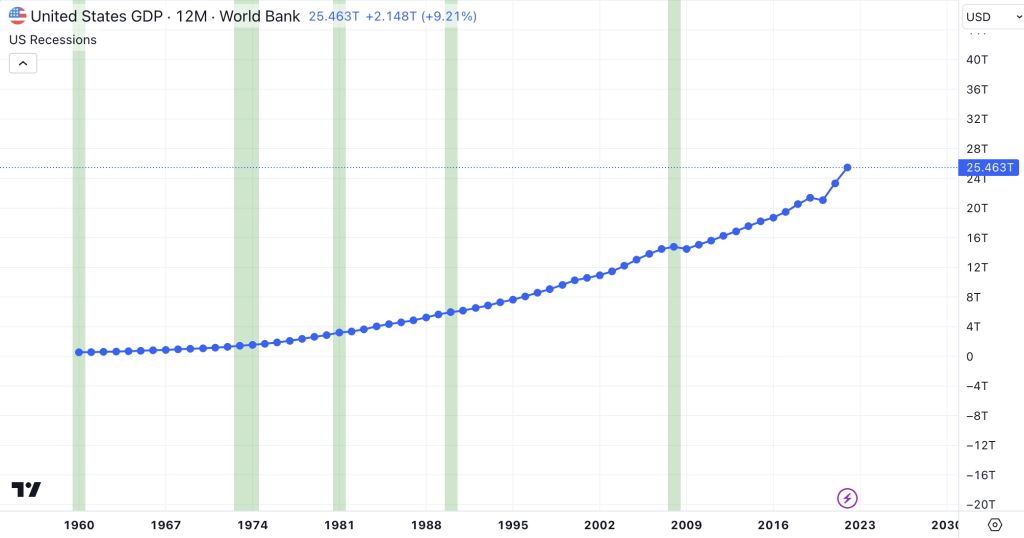

Gross Domestic Product (GDP) measures a country’s economic activity by calculating the total value of all goods and services produced over a specific time, typically reported quarterly and annually.

It encompasses all private and public consumption, government outlays, investments, additions to private inventories, paid-in construction costs, and the foreign balance of trade (exports are added to the value, imports are subtracted).

GDP is vital for several reasons: it directly affects the level of employment, the availability of jobs, the level of tax income, which the government can use to fund public services, and it serves as a key determinant in central bank policy decisions regarding interest rates and inflation.

Positive GDP growth drives business confidence, leading to investment in business development and workforce expansion.

Negative GDP growth can conversely trigger job cuts, lower consumer spending, and cause a retrenchment in business investment.

Recession Signal

you might have heard that a recession is 2 consectuive quarters of GDP decline.

This is not true. Whilst most recessions involve 2 quarters of decline, we have had 2 quarters of decline plenty of times and not had a recession.

This is not an example of cause and effect.

NBER will examine the depth of the GDP decline, its diffusion across different sectors of the economy, and how long it persists.

There is an indicator called the GDP-Based Recession Indicator Index which takes a stand on how to interpret GDP into a recession signal.

Track this yourself

You can find US GDP data here on TradingView, here: https://www.tradingview.com/chart/v7ZG3yMA/?symbol=ECONOMICS%3AUSGDP

Leave a Reply