Average consumer expectations for business conditions are a statistical measure, usually derived from consumer surveys that assess public sentiment about the health and trajectory of the economy.

These surveys ask consumers about their expectations regarding inflation, unemployment, and their own financial situation in the near term.

This matters for a few reasons. Firstly, they directly affect economic output through consumer spending, which constitutes a substantial portion of GDP.

When consumers feel confident about the economy’s direction, they are more likely to spend money, driving demand for goods and services. Businesses respond to increased demand with higher production and investment in new capacity, which in turn fosters job creation.

Conversely, when consumer expectations decline, it can lead to a decrease in spending, which businesses may respond to by reducing production and potentially implementing layoffs, contributing to a self-reinforcing economic downturn.

Recession Signal

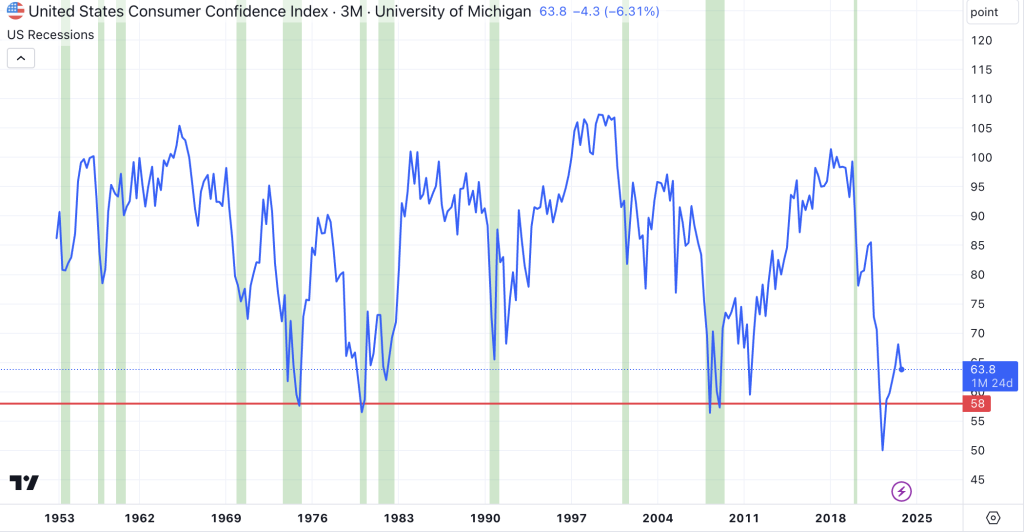

There is no magic number that signals a recession, however, from the chart we can see that every time this metric drops to 58, there is a recession. Doesn’t guarantee a recession, but something to keep an eye on.

Track this yourself

You can view this data on TradingView here: https://www.tradingview.com/chart/v7ZG3yMA/?symbol=ECONOMICS%3AUSCCI

To make life easy you can add US recession indicator, for the green boxes, and draw a horizontal red line at 58.

Leave a Reply